What are we looking for?

With the S&P 500 trading within 4 per cent of its all-time high at the time of this writing, investor attention is focused on stocks showing strong momentum. Our screen aims to uncover outperforming U.S.-listed companies that combine robust price performance with solid fundamentals using Trading Central’s proprietary Quality and Momentum factor rating approach. By including midcap names with liquidity filters, we’re seeking quality stocks that may be overlooked by traditional analysts, yet are well-positioned in today’s resilient equity market.

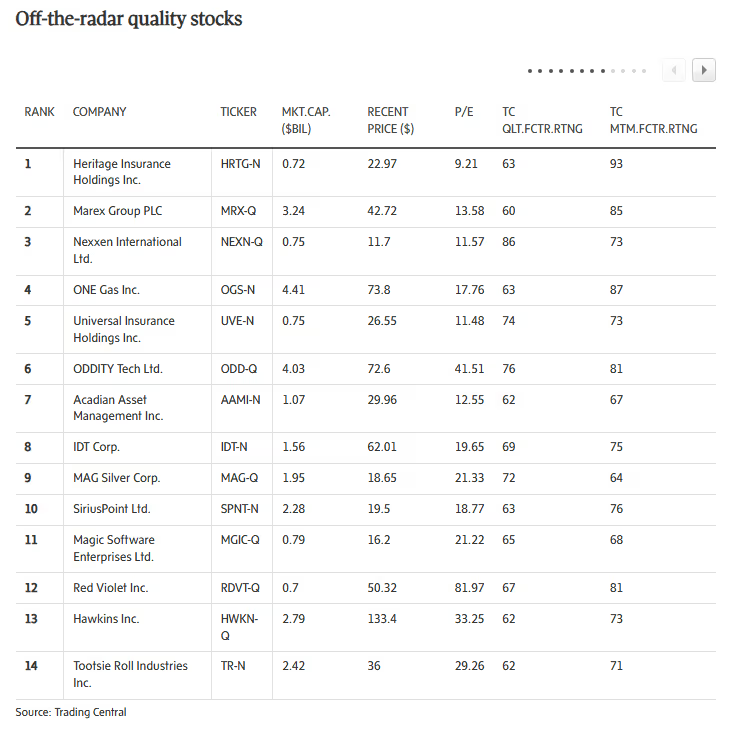

The screen

Using Trading Central’s Strategy Builder, we screened for U.S.-listed stocks with a market capitalization between US$500-million and US$5-billion, focusing our search on small- and midcap companies which are big enough to be stable and liquid, but small enough to still offer significant growth potential and possibly be overlooked by the broader market.

To target liquid and tradable securities, we included only stocks with listed options and set a minimum share price of US$10, helping to avoid highly speculative or illiquid names.

To identify stocks that have seen increased investor interest, we required the 10-day average trading volume to be at least equal to the 90-day average, signalling recent momentum in trading activity.

We focused on companies demonstrating both strong price momentum and solid fundamentals by setting minimum Trading Central Momentum and Quality Factor Ratings of 60 out of 100, respectively. The quality-factor group measures the total financial strength of the company in regard to profitability, the robustness of its balance sheet and earnings quality. The momentum factor refers to the tendency of winning stocks to continue performing well in the near term.

Finally, to ensure our screen included stocks maintaining positive trends, we required that each stock be no more than 15 per cent below its 52-week high, identifying companies trading near their recent peaks and exhibiting sustained strength.

For informational purposes, we have also included year-to-date, and one-year return.

More about Trading Central

Trading Central is a global leader in financial market research and investment analytics for retail online brokers and institutions. Its product suite provides actionable trading ideas based on technical and fundamental research covering stocks, exchange-traded funds, indexes, forex, options and commodities. Strategy Builder, our stock screener, is available through leading retail brokers in Canada and worldwide.

What we found

Topping our list is Heritage Insurance Holdings Inc., a property and casualty insurer that has delivered a remarkable 185-per-cent return over the past year, the highest on our list. With a price-to-earnings ratio of just 9.21 and a momentum factor rating of 93, Florida-based Heritage stands out for both value and price momentum. Despite its modest market cap of US$720-million, the company’s strong TC Quality Factor rating of 63 and sustained price rally make it a compelling choice for investors seeking under-the-radar growth.

One Gas Inc., a regulated natural gas utility serving more than 2.3 million customers across Oklahoma, Kansas and Texas, has the highest market cap on our list at $4.41-billion. The Oklahoma-based company’s stock has a TC Quality and Momentum factor rating of 63 and 87 respectively, which is strong. The stock has been outperforming the broad market like all the stocks in this screen, with a 25.6-per-cent return year-to-date.

Vancouver’s MAG Silver Corp., a leading precious metals producer, caught our attention because of its recent increase in trading volume. The stock’s 10-day/90-day volume ratio of 1.51, the highest in our list, suggests it is currently attracting more attention from investors. The stock recently posted a new 52-week high.

Trading Central Strategy Builder provides a back-testing capability to evaluate how well an investing strategy would have worked in the past. Using a five-year historical period with quarterly rebalancing, the screen described had an impressive 25-per-cent annualized return compared to 14 per cent for the S&P 500 Index.

The investment ideas presented here are for information only. They do not constitute advice or a recommendation by Trading Central in respect of the investment in financial instruments. Investors should conduct further research before investing.

Gary Christie is head of North American research at Trading Central in Ottawa.