Using Trading Central's "Economic Insight" investors can check out up-coming major economic data.

We are looking into the trading week of June 26-30 :

We can select economic data of "High", "Medium" or "Low" importance, or any combination of such filters:

We can select which economies to focus on:

While giving his testimony before the U.S. House of Representatives, Federal Reserve Chair Jerome Powell hinted at the likelihood of further interest-rate hikes for bringing inflation back down the central bank's 2% target.

The U.S. Core Personal Consumption Expenditure (PCE) Price Inflation is one of the economic reports the Federal Reserve focuses on when setting interest rates.

According to Trading Central's "Economic Insight", the U.S. Core PCE Price Inflation (to be released on Friday, June 30) is expected to slow to 4.1% on year in May.

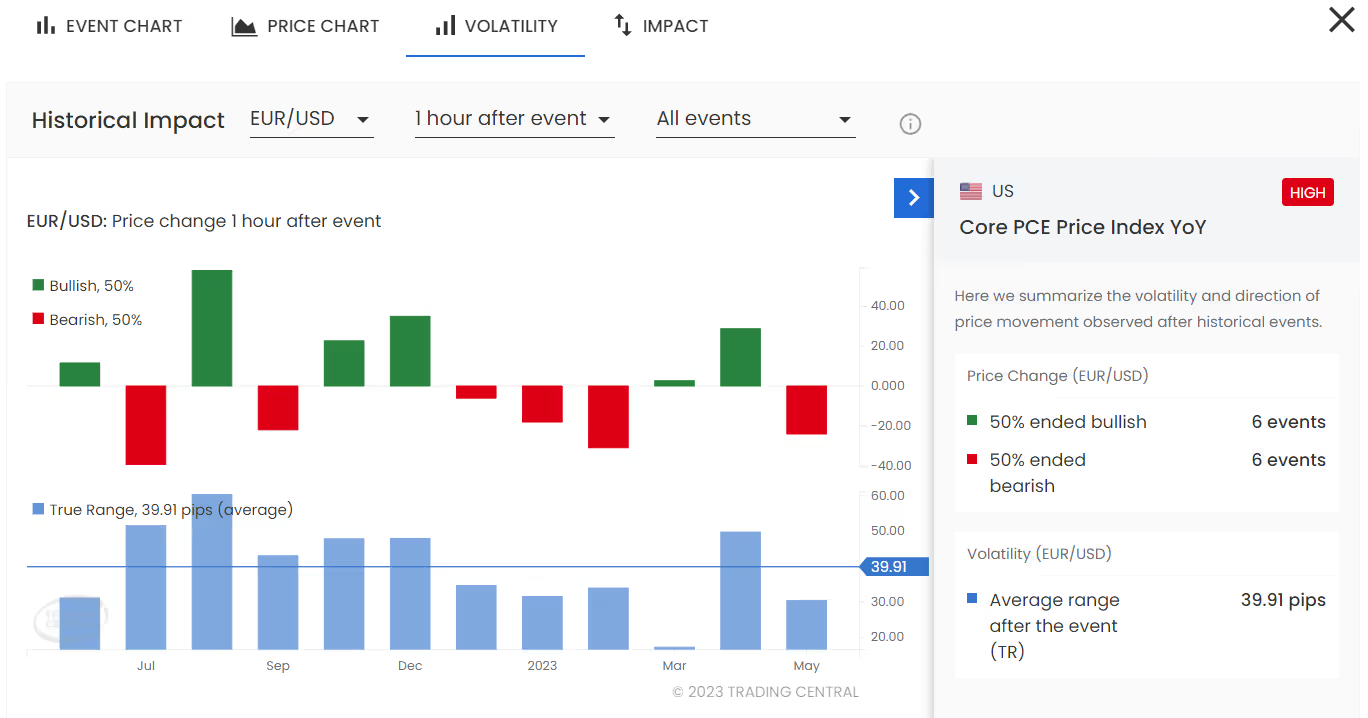

In the past 12 U.S. Core PCE Price Inflation Reports, EUR/USD rose in 50% of times (6 out of 12 reports) within one hour from the report’s release, marking a trading range of 39.91 pips on average.

Other key economic data include:

Monday (June 26)

Germany Ifo Business Climate Index is expected to dip to 91.1 in June.

U.S. Dallas Fed Manufacturing Index may improve to -12.0 in June.

Tuesday (June 27)

U.S. Durable Goods Orders are expected to fall 0.9% on month in May.

U.S. Conference Board Consumer Confidence Index may climb to 103.0 in June.

U.S. Richmond Fed Manufacturing Index is expected to rise to +5 in June.

U.S. New Home Sales may fall 1.7% on month in May.

Canada Inflation Rate may slow to 3.7% on year in May.

Wednesday (June 28)

Germany GfK Consumer Confidence Index is expected to tick up to -23.0 for July.

U.S. Fed Chair Powell and other Central Bank Chiefs will speak in an ECB Forum in Portugal.

Thursday (June 29)

Australia's Retails Sales may drop 0.1% on month in May.

Japan Retail Sales are expected to grow 0.7% on month in May.

Japan Consumer Confidence Index may climb to 38 in June.

Germany Inflation Rate is expected to tick up to 6.4% on year in June.

U.S. Initial Jobless Claims may rise to 275,000.

Friday (June 30)

Japan Unemployment Rate is expected to be stable at 2.6% in May.

Japan Industrial Production may grow 0.5% on month in May.

China Official Manufacturing PMI is expected to bounce to 51.0 in June.

China Official Services PMI may slip to 53.0 in June.

Germany Retail Sales are expected to grow 0.4% on month in May.

Germany Unemployment Rate should remain stable at 5.6% in June.

France Inflation Rate is expected to slow to 4.7% on year in June.

The Eurozone Inflation Rate may slow to 5.6% on year in June.

U.S. Core PCE Price Inflation may slow to 4.5% on year in May.

U.S. Chicago PMI is expected to rise to 44.0 in June.

Canada GDP Growth is expected to speed up to 0.2% on month in April.

Happy Trading!

Source: Trading Central Economic Insight